Restaurant loans and restaurant financing are available to any restaurant owner who needs capital to fund projects such as equipment financing inventory financing building renovations restaurant expansions upgrading computer systems paying off outstanding debt buy out a business partner liquor licenses other licenses pay for franchise.

Restaurant equipment financing rates.

Frymaster manitowoc ice garland cleveland delfield koolaire merrychef kolpak lincoln and merco savory.

Fast free quotes for equipment financing.

Lendio is an aggregator of business financing the company matches customers to the right financing from its network of over 75 business funders.

Equipment financing refers to a loan used to purchase business related equipment such as a restaurant oven a vehicle or a copier scanner.

With our creative methods for restaurant equipment financing it s easy to update your entire restaurant to keep your.

Finance your welbilt inc.

Purchase for 24 to 60 months.

Qualified purchases dates and rates are subject to change.

Call now 888 565 6692.

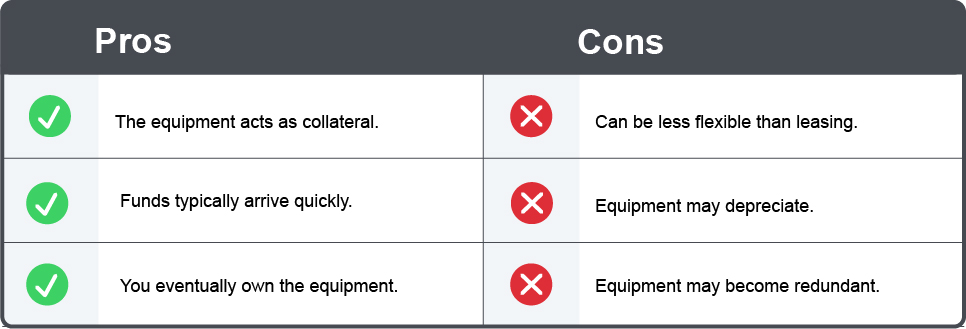

Equipment loans provide for periodic payments that include interest and principal over a fixed term.

Leasing equipment is almost always a better option when you re opening a new restaurant because of the high failure rate of restaurants.

Purchases over 1 000 quality for special rates for extended terms 36 48 an 60 months.

1250 5 star reviews bad credit ok.

Use our free service and find equipment leasing companies.

Currency formerly currency capital is an aggregator of equipment financing offers for restaurant owners.

Best rates on equipment financing loans.

Get the best financing solution for you.

Let s say you have a busy medical practice and need a new mri machine.

First capital business finance leading providers of restaurant equipment financing.

Best restaurant equipment leasing companies.

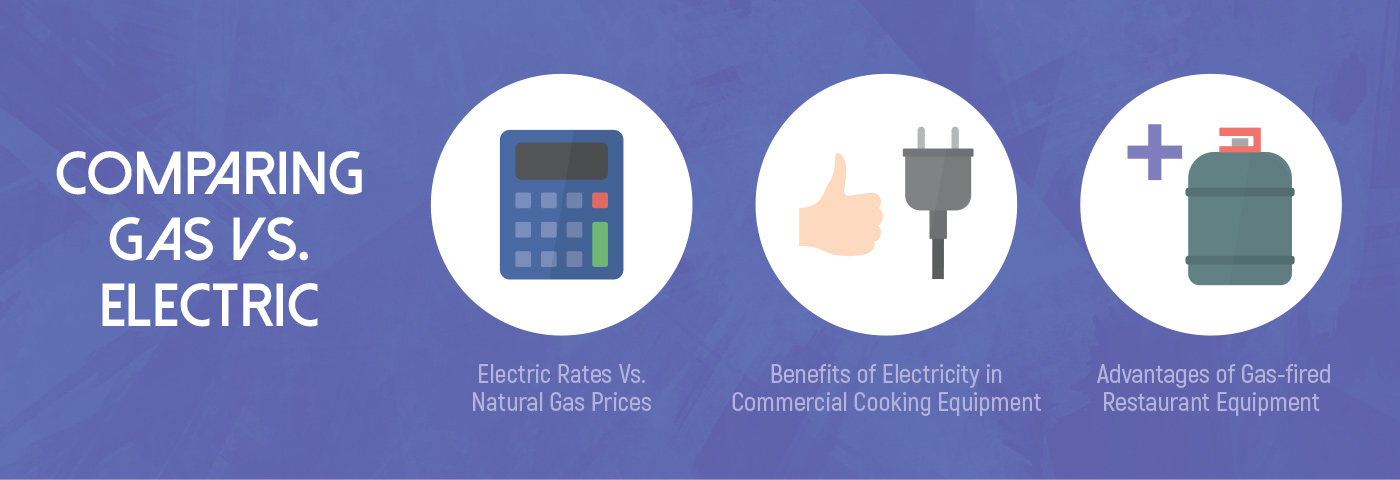

With a lease the manufacturer or the dealer of the equipment may provide the financing.

Benefits of restaurant equipment financing.

These kinds of capital equipment loans carry an interest rate anywhere between 6 and 12 with the rate largely dependent on the credit worthiness of the customer.